Our Services

Your Breakthroughs

Three ways to analyze and improve your cash flows

We offer a three-stage program to release your profits and improve your cash flow by moving your finance department away from manual drudgery.

| 1. Foundations

|

Collect your important business information. | We confirm you’re using the right version of Quickbooks for your business.

We also verify that Quickbooks is set up to easily record and quickly produce the information you need, so you can manage your business. |

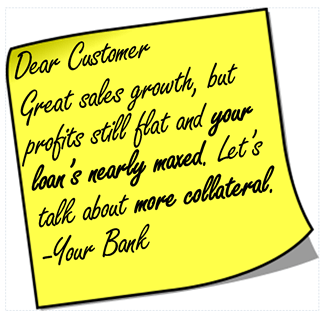

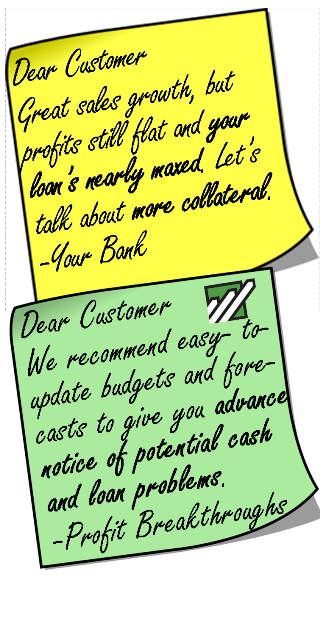

| 2. Basics | Reduce your stress around profits and cash flow. | After the Foundations, we examine and automate your forecasting, budgeting, and reporting Processes.

You bill faster and know where your cash is going – and when it will come back. |

| 3. Advanced | Cut your paperwork, errors, rework, and costs. | We automate your cash collection, timesheets, employee expenses, and payments Processes, so that they talk seamlessly and automatically to Quickbooks.

You spend less time on processing and preparing information, and more time actually using it. |

1. Foundations

Collect your important business information.

We confirm you’re using the right version of Quickbooks for your business.

We also verify that Quickbooks is set up to easily record and quickly produce the information you need, so you can manage your business.

2. Basics

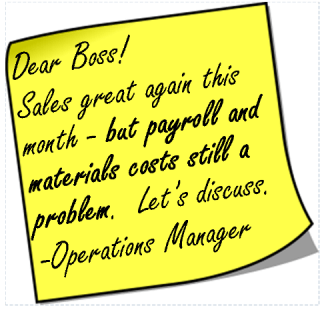

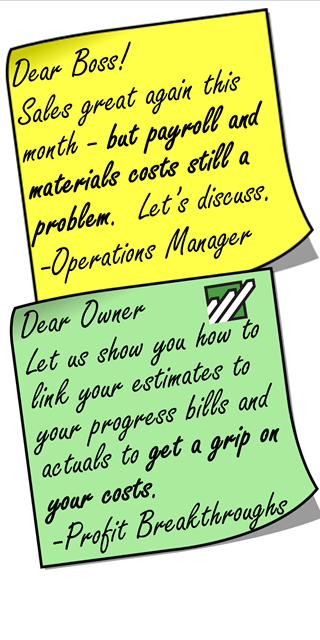

Reduce your stress around profits and cash flow.

After the Foundations, we examine and automate your forecasting, budgeting, and reporting Processes.

You bill faster and know where your cash is going – and when it will come back.

3. Advanced

Cut your paperwork, errors, rework, and costs.

We automate your cash collection, timesheets, employee expenses, and payments Processes, so that they talk seamlessly and automatically to Quickbooks.

You spend less time on processing and preparing information, and more time actually using it.

Our Approach

Questionnaire

We start with a detailed Cash Flow Analysis Questionnaire to target Processes for improvement.

Fixed Fee Diagnostic

We combine the Cash Flow Analysis Questionnaire with your financial information and a half-day examination of your finance department to create a Diagnostic for a fixed fee.

We credit the fee to your account if we proceed with an engagement.

The Diagnostic gives you:

- Benchmark figures for your margins and your cash collection times.

- Recommendations, with an indication of the impact those will have on your cash collection times, and

- Fixed-fee estimates to implement those Recommendations.

We will split out the recommendations and estimates into our Foundations, Basics, and Advanced service offerings.

Our Guarantees to You

No surprise fees. Fixed fee quotes.

Measurable Results. Benchmarked figures: before and after.